Pensions June 2024. When does the payment arrive? And how to view the amounts? There are several new developments for the coming month. Specifically, a recalculation of the amount disbursed between March and April last year, which will integrate into the payroll the increases provided by the 2024 Irpef reform. But not everyone will receive an increase.

Quater scrapping, fourth installment payment by May 31: how to pay to maintain the benefits

The arrears

Those waiting for arrears will see their payroll increase from June. But only those who have not received the arrears expected in the past months.

When do the payments arrive

June 2 is a holiday, so no payment. From June 1, it will be possible to withdraw one's pension at the Post Office. Those who withdraw it from the bank will be able to receive the amount starting from Monday, June 3, 2024.

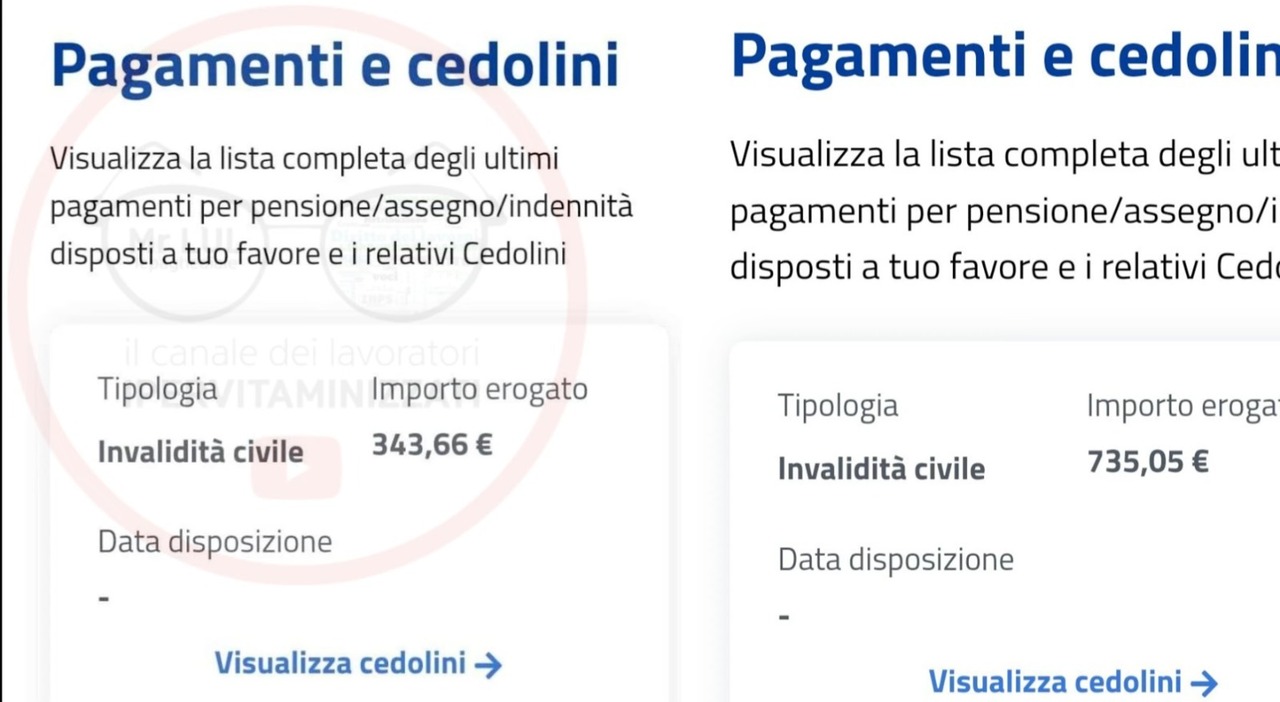

How to view the amounts for June

Beneficiaries of pension and welfare benefits provided by the Institute can obtain the pension certificate (ObisM model): from May 9, in fact, by accrediting themselves on the Inps.it portal, in the section 'Fascicolo previdenziale del cittadino' the certificate is available to pensioners of all managements, including the management ex Inpgi-1 merged into the Institute from July 1, 2022. The ObisM model is published annually taking into account the generalized activities of revaluation of pensions and welfare benefits: in particular, for the year 2024, an increase in pensions for the adjustment to the cost of living, based on the index established on a provisional basis at 5.4% and applied according to the current legislation.

The certificate

The certificate reports, if due, the increase in pensions of an amount equal to or lower than the minimum treatment (pursuant to art. 1, paragraph 310, of the law December 29, 2022, n. 197 - Budget Law 2023): such increase, for 2024, is recognized in the measure of 2.7% without distinction of age of the recipient, for each of the months and until December 2024, including the thirteenth month. In the event of a change in the pension amount, the pension certificate is simultaneously updated. Finally, it is recalled that the certificate is not prepared for pension supplement benefits (Social Ape, extraordinary allowances, so-called 'isopensions' under article 4, of the law June 28, 2012, n. 92): not having the nature of a pension treatment, they are not annually revalued and continue to be paid in the same measure for their entire duration.

How much are the increases

The increases due to the revaluation of pensions in 2024, compared to inflation, led to increases of:

- 100% on pensions up to 4 times the minimum

- 85% on pensions between 4 and 5 times the minimum

- 53% on pensions between 5 and 6 times the minimum

- 47% on pensions between 6 and 8 times the minimum

- 37% on pensions between 8 and 19 times the minimum

- 32% on pensions over 10 times the minimum

The new tax brackets

The new Irpef tax brackets provide:

- up to 15 thousand euros stable rate at 23% for incomes above 15 thousand

- up to 28 thousand a reduction of the rate from 25% to 25% (in 2024 incomes above 28 thousand and up to 50 thousand a rate unchanged at 35%)

- for incomes over 50 thousand euros, the rates are stable at 43%

The increases with the revaluation

The overall increase in pensions due to the annual revaluation of the pension check and the Irpef reform have led, from January 1, 2024, to an increase in pensions up to 5.4%. The Inps table provides:

- for amounts of 1,000 euros an increase of 54 euros gross per month

- for amounts of 1,500 euros an increase of 81 euros gross per month

- for amounts of 2,000 euros an increase of 108 euros gross per month

- for amounts of 2,500 euros an increase of 114.75 euros gross per month

- for amounts of 3,000 euros an increase of 85.80 euros gross per month

- for amounts of 3,500 euros an increase of 88.55 euros gross per month

- for amounts of 4,000 euros an increase of 101.20 euros gross per month

- for amounts of 5,000 euros an increase of 100 euros gross per month

- for amounts of 6,000 euros an increase of 71.40 euros gross per month

This article is automatically translated