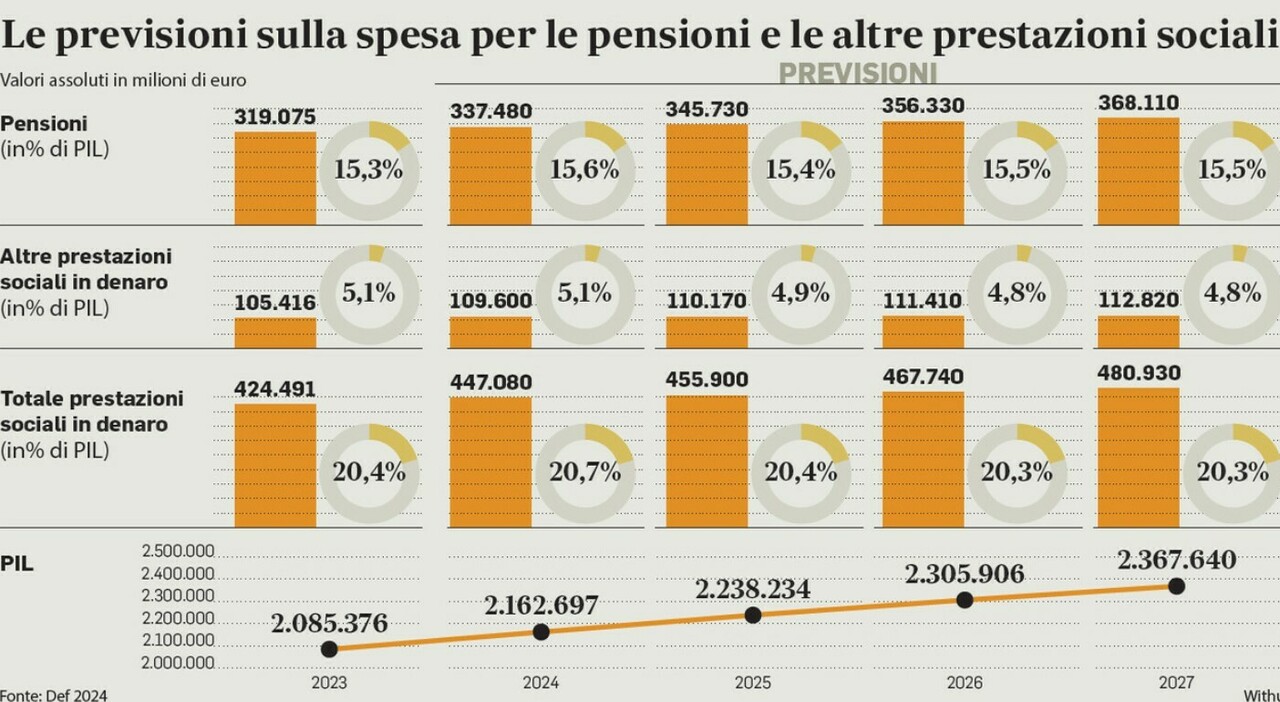

Pensions, Quota 41 is moving away. The expenditure borne by the public accounts for pensions is indeed too high and set to grow. In 2024 it will reach 337.4 billion and for 2025 it will rise to 345 billion. While in 2027 it will jump to 368 billion. A race that is not destined to stop even in the following years. The executive's goal remains to approve a reform that makes the system more flexible and with rules that work for years. On the timing, it was the same Minister of Labor Marina Calderone to explain that the reform "will not be done in the short term". How will it be possible to leave work now? Let's see all the hypotheses on the field.

Quota 41 what it is and requirements

What exactly is it? The idea behind quota 41 is to allow leaving one's job upon reaching 41 years of contributions, regardless of age. A measure that, however, as described, could prove to be very costly for public finances. Hence, in the past, additional requirements were introduced to circumscribe its scope of action. For example, restricting the pool of potential beneficiaries to so-called "early workers", i.e., those who have performed at least 12 months of actual work, even non-continuous, before the nineteenth year of age. Among other requirements, it was then introduced to be in one of the specific categories provided: unemployed, caregivers, civil invalids or having performed wearing or strenuous jobs.

The hypotheses

The proposals such as the introduction of retirement with 41 years of contributions regardless of age, even if softened in costs for the State (but not for the pensioners) by a contributory recalculation of the pensions, are destined to remain in the drawer. But what is happening to the pension system? Several factors weigh in. The first is structural: the demographic trend. The number of pensioners is gradually increasing, and the number of workers destined to "support" them with the payment of contributions is instead set to decrease. Not because unemployment is increasing, but rather because there are fewer and fewer people of working age. The second reason is more contingent: the return of inflation.

Quota 103 and Ape sociale

The confirmation of Quota 103 with the contributory recalculation for those who access it, the news on the Social Ape, and the cut in the revaluation for the richest pensions, have all been used to raise funds. The government would like to move to Quota 41 for everyone, without any age requirement but with a penalty on exit with contributory recalculation. Thus, an alternative to early retirement would be created, with a discount in terms of contributions (but resulting in a lower pension).

The expenditure

The expenditure for pensions is increasing, especially due to the adjustment of pensions to inflation but also the contributions paid are growing thanks to the increase in employment: in 2023, according to the Report on the activity in the year of the INPS just published, 269.6 billion euros were disbursed for pensions with an increase of 6.34% while contributions into the Institute's coffers amounted to 214.6 billion euros with an increase of 4.44% compared to 2022 (+4.65% compared to forecasts), a figure also nominal and that includes the price increase.

The INPS data

The INPS data together with the Istat data on the significant growth of employment in 2023 (+481 thousand employed on average per year) have led the Minister of Labor, Marina Calderone to say that the numbers "justify" the Government and "encourage to pursue changes to strengthen and consolidate good and quality work in Italy". Overall, looking at the balance, the revenues - which the INPS indicates in the item contributions but which do not concern only pension contributions but for example also state transfers - touch in the year 395.86 billion with an increase of 4.43% on 2022.

Payments

The payments - which do not concern only pensions but range from the single allowance to unemployment benefit, from maternity bonuses to the inclusion allowance - amounted to 396.86 billion with an increase of 7.36% on 2022. The data is affected by adjustments to inflation with the final percentage calculated by Istat at 8.1%. The expenditure for institutional benefits was 317 billion. Among these, 38.6 billion euros (+10.16%) were disbursed for temporary benefits (single allowance, Naspi, bonuses etc) with a growth of 12% for Naspi and 38% on the Single Allowance introduced however during 2022. There were 17.8 million pensions and 3.6 million benefits for disability.

The Def

The data arrives while the debate on the Def and the long journey towards the Budget Law begins, which however should not widen the scope in pension matters given the constraints on public accounts. If there will still be talk of early retirement compared to the old age, it is possible that work will be done to keep the minimum requirement of 41 years of contributions by raising the minimum necessary age in the face of the contributory requirement.

The goals

The Minister of Labor, Marina Calderone, in recent weeks has reiterated that the goal during the legislature is to "wisely and attentively revisit what is the intergenerational pact, as it is the basis of an "efficient system. In this regard, the government will evaluate all interventions to protect those who have to leave work early but because they have worked a lot and for those who are young and still have to build their pension position".

The funds

However, it is unlikely that approval will come by 2025. Also because in the next Budget Laws Italy will have to allocate resources to reduce the accumulated deficit, about 5 billion euros a year according to forecasts. And above all, it will not be possible to make extra-deficit to finance new economic measures. The 2025 Budget will therefore be "poorer" than the last. And unless there are cuts by the ECB or economic growth - but this is a double complicated scenario - the news should not be positive.

This article is automatically translated